I.R.M.A.

Individual Risk Management Architect

The evolution from the sale of insurance programs

to the scientific management of insurable risks.

Innovative scientific insurance consulting technique

that will differentiate you in the market and will boost your production!

All The Tools You Need ... in ONE software!

|

Our vision is to disrupt the financial and insurance consulting industry with our innovative software and methodologies. Our main goal is to re-engineer & rebrand the insurance advisor and redefine his role. Based on cutting-edge neuroscience research on risk perception and decision making, we believe that our methodologies and innovative software will shape the insurance industry of the future. Watch the presentation VIDEO! |

A truly unique software with 11 global innovation awards

An innovative certificate for those who want to stand out in risk management and analysis of the needs of individuals.

We have designed a highly effective strategy, which completely differentiates the insurance advisor at all levels: from the business plan and the penetration in high-income markets, to the utilization of the Internet and the personal branding strategy, in order to be immediately approached by citizens for his scientific advice and stop the agonizing "hunt" for prospective customers.

A new integrated

scientific strategy

The new overall strategy is based on 4 pillars as they were formulated after 11 years of research and 6 years of practical application in the market:

- Through our innovative software and using the science of Risk Management, the risks that threaten an individual or a business are measured in a simple but scientific way. Thus, objective prioritization and quantification of risks is achieved and an insurable risk analysis is automatically produced (insurable risk profiling).

- The software includes important tools and calculators, such as pension calculator, investment profile calculator, sales calendar, profiling and customer categorization tools and many others that contribute to the development of the insurance intermediary into a scientific advisor.

-

Pioneering 11-year neurobiological research that proves that apart from the lack of education, prevention and insurance consciousness of the citizen, there are still 5 functions of the brain that do not allow him to accept the risk, understand it and make the decision to cover it insurance. A methodology that has been applied in practice and that allows the consultant to overtake any defenses and resistances and to sharply increase the closing rate.

-

Use of modern and easy technologies to approach the citizen, exploiting the internet to address all the challenges of today's consultant and manager, in a new digital reality that is here to stay.

- A new powerful CRM program specifically for insurance intermediaries that is integrated into the software for the full organization of everyday life, contacts and existing customers so that you do not miss any opportunity to cooperate. With an activity listing calendar, contracts to be renewed, appointments, actions, and automatic notifications.

A student program consisting of 20 live webinars lasting 2 hours, with the possibility of attending from any part of the world. They are taught in an innovative way, everything that the modern consultant needs to know in order to stand out and excel in today's challenging market.

The training is supported by a modern e-learning platform which contains all courses in digital form for repetition and better assimilation, role-playing videos, sales and activity organization tools, as well as a 24/7 support forum.

4 New tools ... to the services of the modern consultant!

We never stop developing our software to provide the best experience to you and your customers with a fully updated and upgraded tool.

With functions that will make your professional everyday life easier and will boost your production!!

CRM

Record and organize your contacts and leads. Take note of your actions so far, but schedule also the future ones.

With easy management and editing of a record, with the ability to enter all the necessary data and categorize.

Enter your existing lists with one click... and the time-consuming management to date is becoming a breeze!

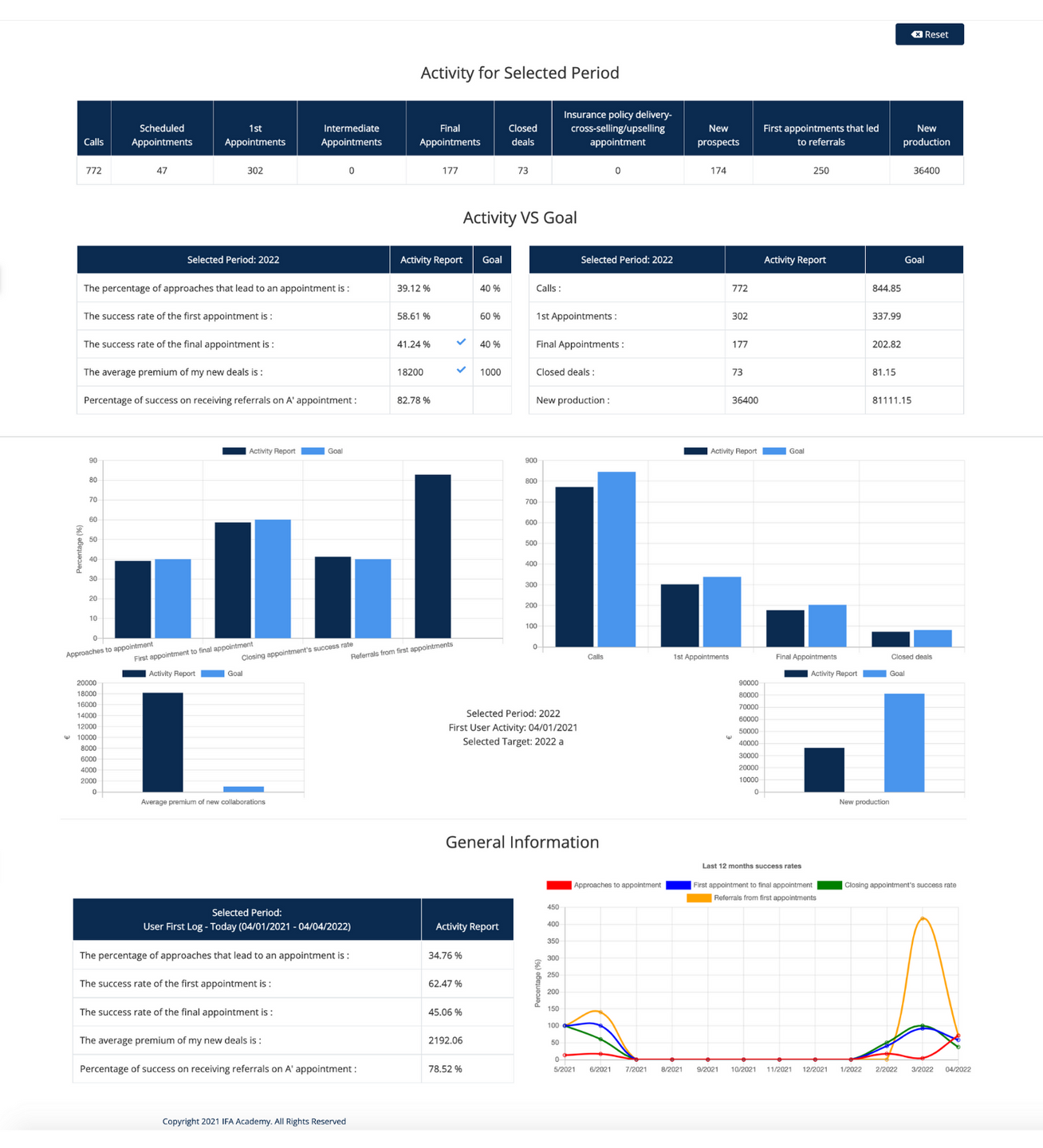

Automatic activity logging

Automatic recording of your daily activity, through the use of CRM, with a special algorithm, easily in this unique tool. Track your results (percentages and indicators) in impressive charts and see your success indicators change over time!

Βusiness plan

You are an entrepreneur!

Make the right plan.

Set 3-year goals, record professional and family expenses, and organize your daily routine always in control!

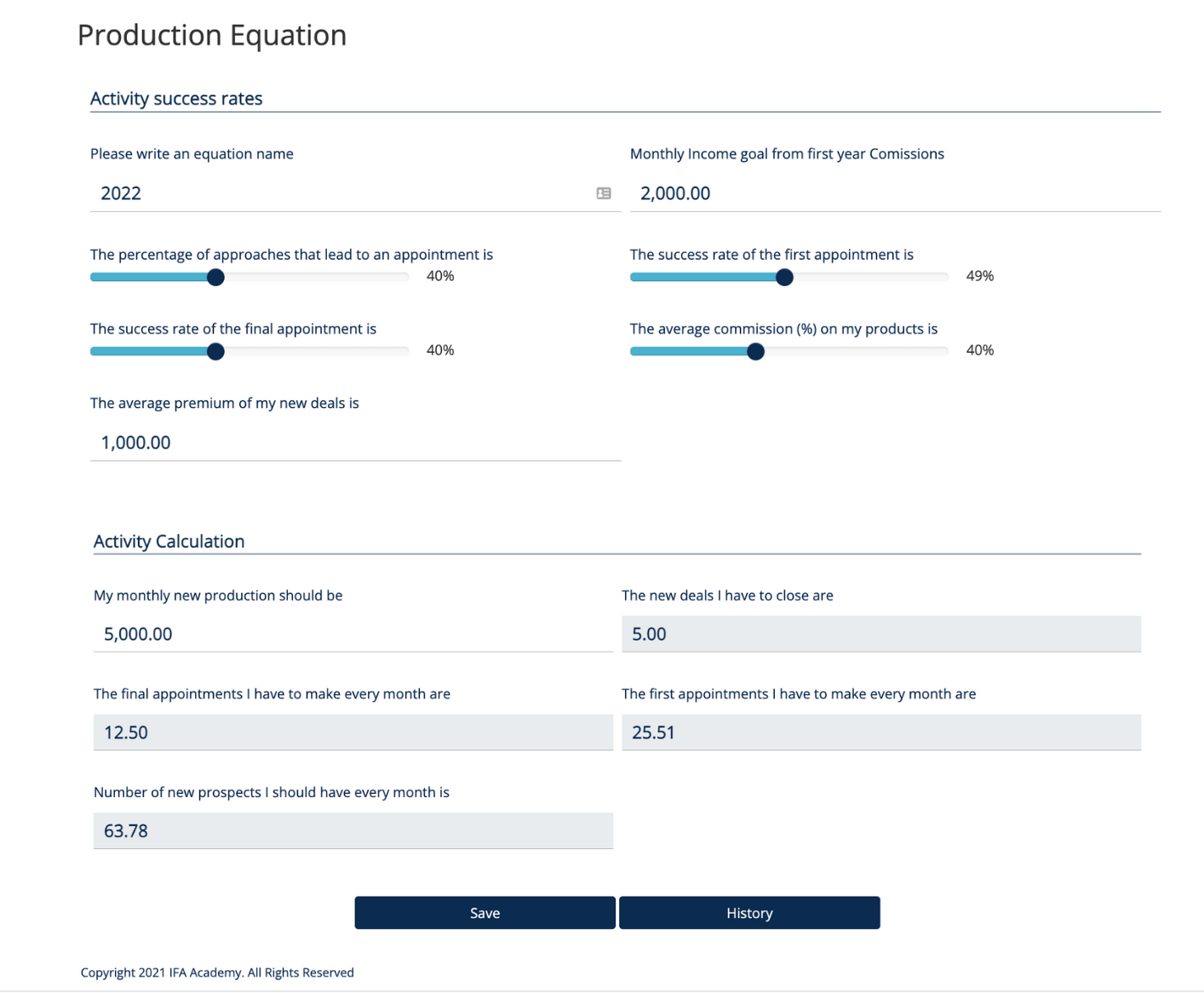

Production equation

Calculate for the first time accurately the production and the actions you need to take daily in order to get the desired results. And in relation to the automatic recording of activity, get your recorded success rates, without complex calculations and time-consuming procedures.

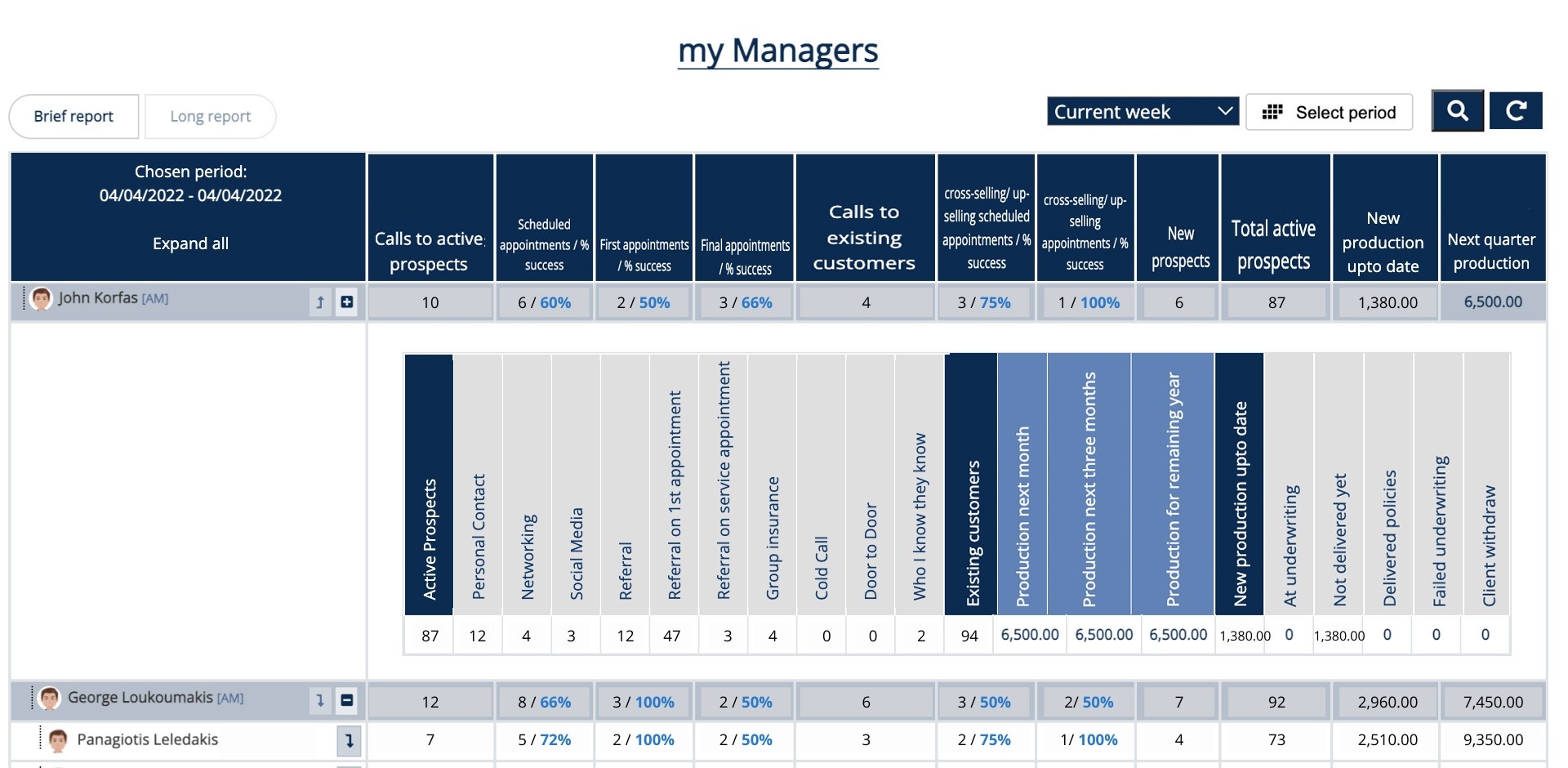

Μanager report tool

The ultimate tool of managers!

A unique tool for global standards, especially for teams!

Now there is the possibility to integrate in our programs groups of consultants with their managers and collaborate in real time.

Everything you need to know about your daily activity on one platform!

The number of telephones, contacts, appointments, recommendations and the projected production of the next period. Get all the data "at a glance" but also in a full detailed report with the success rates and identify immediate problems where you need to focus.

IFAAcademy

Risk Management Architecture

Risk is our business...

A comprehensive Certification Program, an internationally awarded methodology and an innovative needs analysis software, lead to a new overall strategy that changes the standards in the insurance market worldwide.

It is a program with important success stories in the real market, such as the educational cooperation with the largest Cypriot insurance company.

This collaboration paid off greatly to the company by recording

- an impressive 250% increase in production over 5 years,

- 120% increase in quality staffing

and - an 80% increase in retaining new partners.

It also counts more than 1000 graduates in Greece, Cyprus and now worldwide, with a recorded increase in production from 25% to 150%, only in the 1st year, before the completion of the educational cycle, especially in low penetration sectors such as life and disability funds.

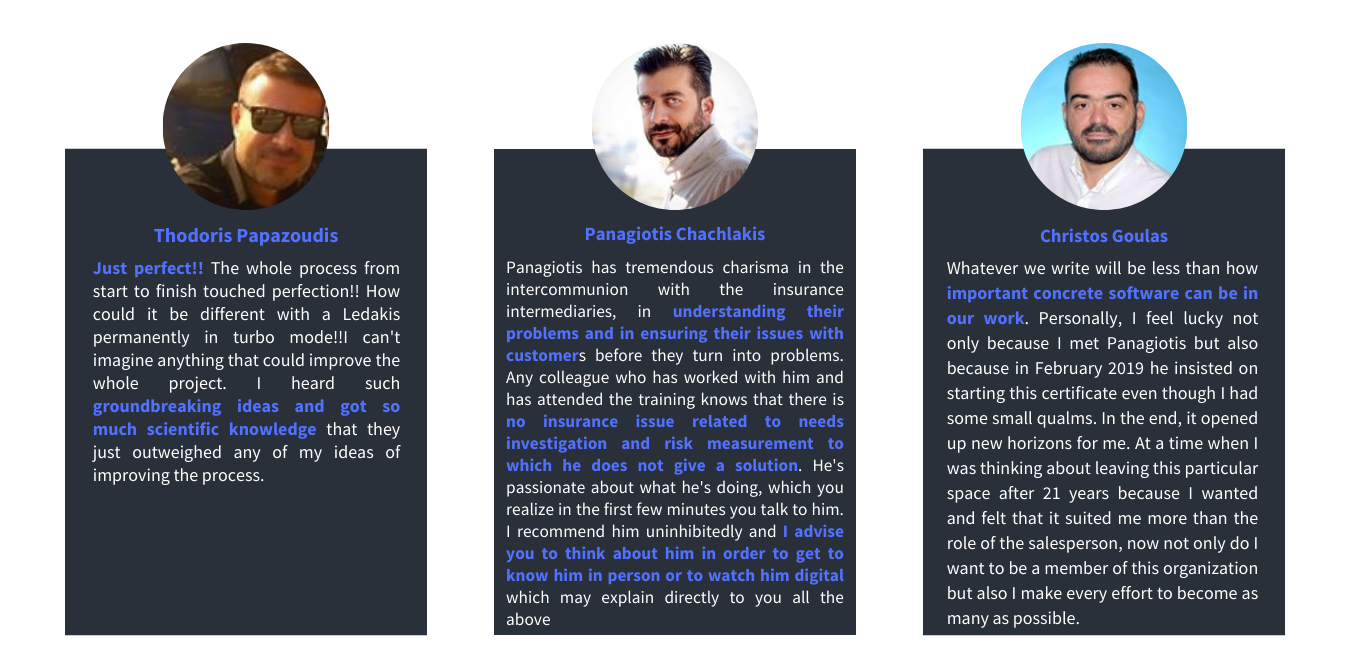

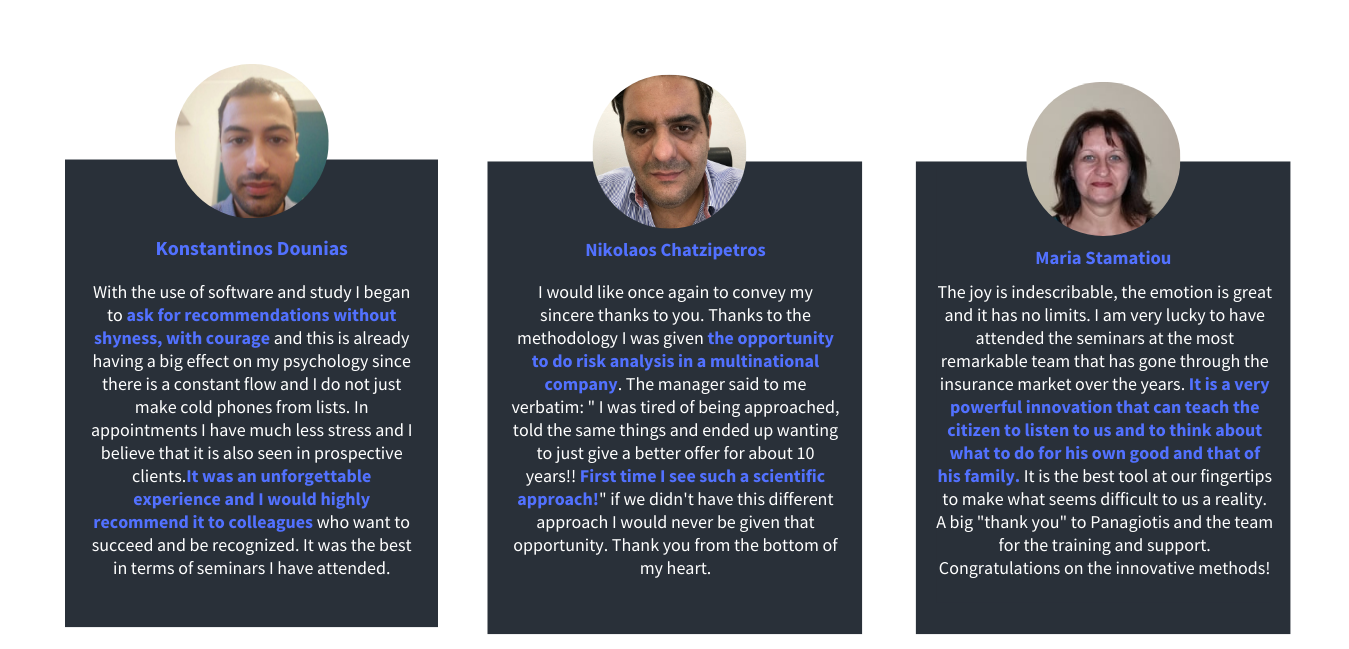

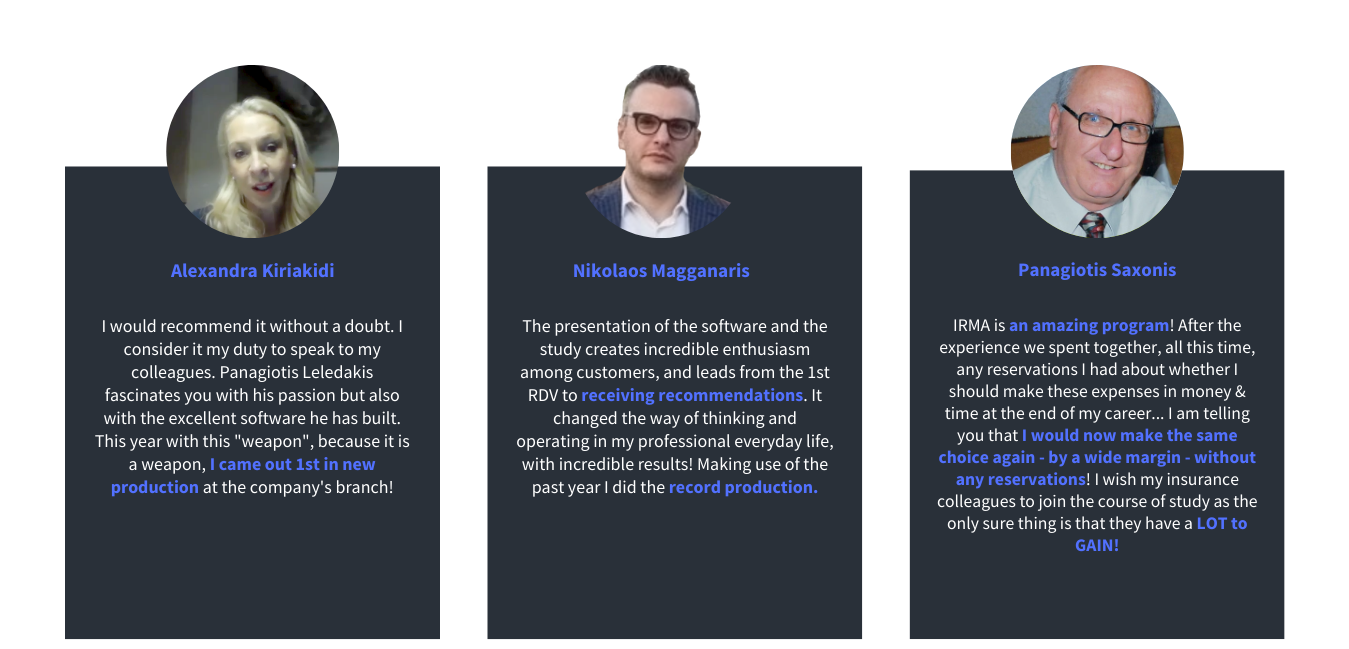

TESTIMONIALS

How our graduates describe their experience

With 11 international awards and distinctions from reputable and internationally recognized organizations:

- "Best Insurance & Finance Advisor Training Institute 2021" by the Coprtoday organisation.

- "Best in Insurance Training" - The Corporate Livewire Greece Prestige Awards 2020/21

- 3rd place at the 6th Asia Trusted Life Agents & Advisers Awards - category: insur-tech

- "Best Insurance & Finance Advisor Training Institute 2020" in a competition held in London by Corporate Vision, member of AI Global Media.

- Panagiotis Leledakis was awarded as one of the 25 Top InsurTech CEO's of 2020 (Technology Innovators).

- Among the 50 best educational organizations worldwide by GFELAt

- MIT Enterprise Forum Greece, among the top 10 ideas. A competition from the world-renowned and prestigious Massachusetts Institute of Technology.

- Best startup company in the ed-tech category at the Startup Europe Awards.

- Winner of the innovation competition of the Federation of Industrialists of Cyprus.

- Among the 4 best startups in the "Get in the Ring" contest.

- Silver award at Boussias Digital Finance Awards 2022 - For our innovative CRM/PRM

The initial results are immediately visible, from the very first lessons

as part of the training cycle is the simultaneous practical applicationin the daily life of the consultant.

- Starting from an innovative needs analysis that impresses the customer, we build even more confidence in the partner, who with a fresh approach can differentiate and sharply increase his activity and thus his production.

- With 20 upgraded ways of finding customers, we solve once and for all the most important challenge of the insurance intermediary. A mixed strategy with upgraded classic ways but also many innovative digital ones.

- Presentation techniques of insurance plans that ensure a sharp increase in closure.

- Cross selling & Upselling: With this innovative methodology, the consultant can be "re-introduced" to his existing clients, make new contracts and get valuable recommendations.

- Internet marketing: Practical and easy to implement digital solutions, in order for the consultant to utilize the internet and get in touch with inexhaustible sources of new customers.

- Special techniques of penetrating the market of high incomes.

- Managers can use the student program to retrain their existing partners, evolving them with a new innovative methodology that will inspire them again and lead them to the new digital era. This new professional identity can lead to the recruitment of young, talented millennials and accelerate their education while sharply increasing their viability in this career.

Panos Leledakis

Founder & CEO IFAAcademy

Our vision is to shake up the financial and insurance consulting industry with our innovative software and methodologies. Our main goal is to redesign and upgrade the current insurance intermediary and redefine its role, giving it a new, modern identity, that of the "Insurable Risk Manager", the Insurable Risk Manager.

I.R.M.A. Course Levels

Level 1

- Use of insurable risk analysis software & sales pitch

- Use of the specialized CRM & Activity report features

- Neurobiological research-based counseling methodology

- A fresh approach of the client - Scripts and mindset

- Use of Calculators (Life & Disability insurance, Pension, Investor profile)

8 x 2h sessions

350€

Level 2

- New ways of prospecting (20 ways digital and non-digital ones)

- Cross-selling & Up-selling strategies

- Professional service for existing clients

- Time management

- Objection handling with neuroscience

- Innovative closing techniques

6 x 2h sessions

250€

Level 3

- Internet marketing

- Advanced digital meetings

- Innovative branding strategies

- Social media marketing

- Content marketing

- Use of AI tools to be faster, more efficient and more productive than ever before

8 x 2h sessions

250€

I.R.M.A. Course Pricing

The participation in the certification programe and the use of the software has two separate costs.

1) The monthly subscription fee for the use of the software, 39€/month

2) The cost of the training programe – exams and certification in “Insurable Risk Management”

The training fees can be paid in 1, 2, or 9 installments.

In European countries, VAT will be applied where applicable. A small transaction fee or Stripe processing fees will apply.

What are you waiting for?

Register now and get certified as an

Individual Risk Management Architect

Register Now